- Technology

US fintech Ping Express, executives convicted for $160 million laundering : faces 5-year probation

Two US-based Nigerian fintech executives pleaded guilty to failure to maintain an effective anti-money laundering policy.

US Department of Justice (DoJ) in a statement said Ping Express “transferred millions of dollars from the U.S. to Africa has admitted that it failed to adequately guard against money laundering.”

U.S. Attorney for the Northern District of Texas Chad E. Meacham announced that Ping Express U.S. LLC pleaded guilty to failure to maintain an effective anti-money laundering program.

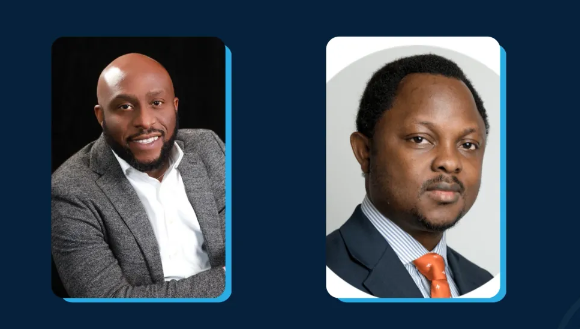

Ping Express has Nigerian-born executives – CEO Anslem Oshionebo and Ping COO Opeyemi Odeyale – who pleaded guilty to failure to maintain an effective anti-money laundering program.

Ping’s IT/ Business Development Manager, Aleoghena Okhumale, pleaded guilty to knowingly transmitting illegally-derived funds.

The CEO and COO were recently each sentenced to 27 months in federal prison, while the IT/Business Development Manager received a prison sentence of 42 months, DoJ said.

The company faces five years of probation and a fine of up to $500,000. The sentencing is scheduled for Dec. 19, 2022.

Oshionebo and Odeyale received 27-month prison sentences for failing to maintain effective anti-money laundering controls and unlicensed money transmitting, according to US legal filings.

The Dallas-based company they owned and operated — Ping Express US LLC — faces five years of probation and a fine as high as $500,000 after pleading guilty to a similar charge, while another executive received a 42-month sentence.

“Through our special agents and forensic accountants, we work endlessly to eradicate crimes involving money laundering and bulk cash smuggling,” said Christopher Miller, Acting Special Agent in Charge of Homeland Security Investigations Dallas.

“Our investigative reach provides access to a wide range of financial networks allowing HSI to disrupt any criminal organization attempting to exploit global trade.”

According to court documents, DoJ said the company was licensed to transmit money but was not licensed to conduct currency exchange – charged U.S. customers a fee to remit money to beneficiaries in Nigeria and other African nations.

By law, Ping was required to report any suspicious transactions to regulators. In plea papers, it admitted that it failed to file a single report over a three-year period, despite a significant amount of suspicious customer activity.

The company outlined its anti-money laundering policy in a memo to state regulators, claiming it would cap first-time customer transactions at $499, cap daily transactions at $3,000, and cap monthly transactions at $4,500.

However, in plea papers, the company admitted it allowed more than 1,500 customers to violate these rules. In one instance, Ping allowed a customer to remit more than $80,000 in a single month – more than 17 times the purported limit.

Ping also admitted that it conducted money transmission business in states in which it was not licensed to do so, including Nevada, New Jersey, Utah, West Virginia, and Connecticut.

The company claimed to have software that could detect and deter transmissions initiated in “unlicensed” states, but in reality, it admitted, the program didn’t function. In its summaries to state regulators, Ping chose to include a column labeled “IP Location,” but only recorded states in which Ping was properly licensed: Texas, Maryland, Georgia, Washington, and Washington, DC.

In less than three years, the company transmitted more than $167 million overseas, including $160 million transmitted to Nigeria, DoJ said.

The company admitted it failed to seek sufficient details about the sources or purposes of the funds involved in the transactions, or the customers initiating the transmissions.

Three individuals – including two of Ping’s top customers – previously pleaded guilty to transmitting illegally-derived funds through Ping.

One, Collins Orogun, admitted that he accepted a fee in exchange for transferring money for “romance scam” fraudsters and other criminals.

In one instance, an Indiana woman sent $15,00 to “Carson Jacks,” a purported oil roughneck in the Gulf of Mexico she fell in love with online, after he told her he’d contracted malaria. In another, a second Indiana woman sent $6,300 to “Thomas Ken,” a purported Irish ship captain she fell in love with online, to fix his ship.

In two years, Orogun received more than $1.3 million in cash, cashier’s checks, and wires into several U.S. bank accounts he controlled, and then quickly moved more than $1 million of the funds to Africa through Ping.

He faces up to 20 years in federal prison and is set to be sentenced on Jan. 23, 2023.

About Ping Express

Founded in December 2014, Ping Express officially commenced operations in 2015 to provide an alternative means for global remittance. The fintech company was licensed as an international money transfer operator (IMTO) by the Central Bank of Nigeria in 2016.

Ping Express has previously signed several African celebrities including—Nigerian comedians; Basket Mouth, Wamilele, and Woli Arole; Zimbabwean comedian, Alfred Kainga; Nigerian musician, May D—as brand ambassadors.